Impact on Stockholders of Approval or Disapproval of this ProposalIf this proposal is approved, existing stockholders will suffer dilution in ownership interests and voting rights as a result of the issuance of shares of Common Stock pursuant to the Committed Equity Financings. Assuming the issuance of all of the Purchase Shares and Commitment Shares, Keystone and Arena would collectively own approximately 50.6 million shares of Common Stock, assuming the shares to be issued are sold at a price of $1.00 per share. Such shares would constitute approximately 77.6% of the outstanding Common Stock. Because the issuance price of the Purchase Shares and Commitment Shares may be adjusted, the number of shares that will actually be issued may be more or less than such number of shares. The ownership interest of the existing stockholders (other than Keystone and Arena) would be correspondingly reduced. The number of shares of Common Stock described above does not give effect to (i) the potential future issuance of shares of Common Stock upon the conversion of the Series A Preferred Stock and Series B Preferred Stock or exercise of the PIPE Warrants, (ii) the potential future issuance of additional shares of Common Stock due to potential future anti-dilution adjustments on the Series A Preferred Stock, Series B Preferred Stock or PIPE Warrants, (iii) the potential future issuance of shares of Common Stock pursuant to other outstanding options and warrants, or (iv) any other potential future issuances of Common Stock. The sale into the public market of these shares also could materially and adversely affect the market price of the Common Stock.

If the stockholders do not approve this proposal, the Company will be unable to issue any Purchase Shares pursuant to the Committed Equity Financings. Accordingly, if stockholder approval of this proposal is not obtained, the Company may need to seek alternative sources of financing, which financing may not be available on advantageous terms, or at all, and which may result in the incurrence of additional transaction expenses. The Company expects to receive gross proceeds of $50.0 million upon issuance of all of the Purchase Shares.

The Company’s ability to successfully implement its business plans and ultimately generate value for its shareholders is dependent upon its ability to raise capital and satisfy its ongoing business needs. If the Company is unable to issue Purchase Shares pursuant to the Committed Equity Financings, it may be unable to fully satisfy its ongoing business needs on the terms or timeline it anticipates, if at all, the effect of which could materially and adversely impact future operating results, and result in a delay in or modification or abandonment of our business plans.

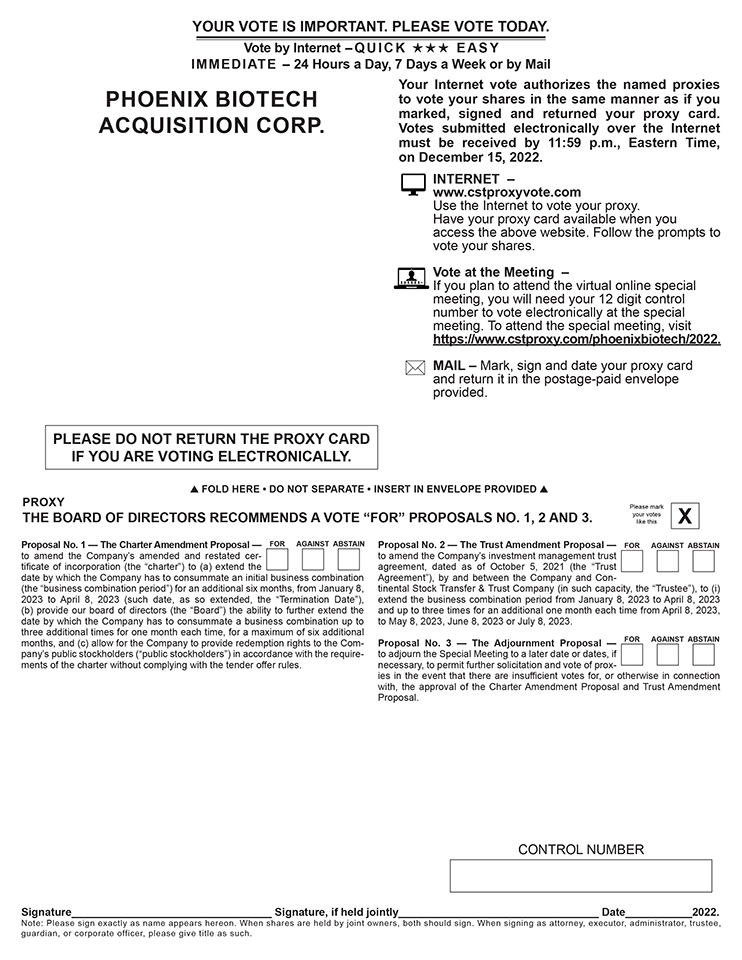

Vote Required; Board Recommendation

The affirmative vote of the holders of a majority of the votes cast at the Special Meeting will be required to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ISSUANCE OF SHARES OF COMMON STOCK, IN ACCORDANCE WITH NASDAQ LISTING RULE 5635, PURSUANT TO THE COMMITTED EQUITY FINANCINGS. | ✓ |

SUBMISSIONPROPOSAL 4: APPROVAL OF STOCKHOLDERTHE CERO THERAPEUTICS HOLDINGS, INC. 2024 EQUITY INCENTIVE PLAN, AS AMENDED, TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK AVAILABLE FOR ISSUANCE UNDER THE PLAN AND the number of shares that may BE issued pursuant to incentive stock options BY AN ADDITIONAL 2,000,000 SHARES

Overview

On April 3, 2024, the Board approved, subject to stockholder approval, Amendment No. 1 to the Plan (the “Amendment” and the Plan as so amended, the “Amended Plan”) to increase the number of shares available for issuance under the Plan and the limit on the number of shares that may be issued pursuant to incentive stock options by, in each case, 2,000,000 shares of Common Stock to 7,172,590 shares and 7,099,252 shares, respectively. Of the resulting share reserve, approximately 2,683,204 shares (683,204 shares available for grant as of March 31, 2024 plus 2,000,000 shares being requested under this proposal) would be available for new awards, not including any shares that would become available again upon the expiration, termination, cancellation, cash settlement or forfeiture of certain previously-issued awards, as described below. A copy of the Amended Plan is attached to this proxy statement as Appendix A.

The compensation committee of the Board (the “compensation committee”) believes the number of shares of common stock available for issuance under the Plan is not sufficient to make the grants that will be needed over the next year to provide adequate long-term equity incentives to the Company’s key employees. Approval of the Amended Plan will enable the Company to continue making equity compensation grants that serve as incentives to recruit and retain key employees and to continue aligning the interests of its employees with stockholders.

Plan Development

In determining the number of shares to add to the authorized share pool for the Plan, the compensation committee considered a number of factors, including key data relating to outstanding equity awards and shares available for grant, historical share usage, and future share needs.

The compensation committee also considered the fact that the Company’s compensation program will be heavily weighted to equity compensation, and that the Company’s equity compensation will be heavily weighted to performance-based incentives, including:

| ● | Anticipated equity awards to be granted in 2024 covering approximately 4.6 million shares of common stock will be in the form of stock options; |

| ● | Certain equity awards granted to executives in 2024 are subject to acceleration for the achievement of goals relating to the Company’s clinical development; and |

| ● | Executive equity is heavily weighted to instruments that require strong performance thereby incentivizing the delivery of value. |

The Company expects that the shares requested under the Amended Plan will provide for grants to Company personnel for the remainder of 2024 and will be augmented by the annual evergreen provision as described in the 2024 Plan.

Description of the Amended Plan

A summary description of the material features of the Amended Plan is set forth below. The following summary does not purport to be a complete description of all the provisions of the Amended Plan and is qualified by reference to the Plan, as proposed to be amended by the Amendment. Stockholders should refer to the Amended Plan for more complete and detailed information about the terms and conditions of the Amended Plan.

Eligibility. Any individual who is an employee of the Company or any of its affiliates, or any person who provides services to the Company or its affiliates, including members of the Board, is eligible to receive awards under the Amended Plan at the discretion of the plan administrator.

Awards. The Amended Plan provides for the grant of incentive stock options (“ISOs”), within the meaning of Section 422 of the Code to employees, including employees of any parent or subsidiary, and for the grant of nonstatutory stock options (“NSOs”), stock appreciation rights, restricted stock awards, restricted stock unit awards, performance awards and other forms of awards to employees, directors and consultants, including employees and consultants of the Company’s affiliates.

Authorized Shares. The maximum number of shares of Common Stock that may be issued under the Amended Plan will not exceed 7,172,590 (the “Share Reserve”). The Legacy CERo options that were assumed as part of the Business Combination and converted into options to purchase shares of Common Stock were not counted in the Share Reserve. In addition, the Share Reserve will automatically increase on January 1 of each year for a period of ten years, commencing on January 1, 2025 and ending (and including) on January 1, 2034, in an amount equal to (1) five percent (5%) of the total number of shares of the Fully Diluted Common Stock determined on December 31 of the preceding year, or (2) a lesser number of shares of Common Stock determined by the Board prior to January 1 of a given year. The maximum number of shares of Common Stock that may be issued on the exercise of ISOs under the Amended Plan is equal to 7,099,252 shares.

Shares subject to stock awards granted under the Amended Plan that expire or terminate without being exercised or otherwise issued in full or that are paid out in cash rather than in shares do not reduce the Share Reserve. Shares withheld under a stock award to satisfy the exercise, strike or purchase price of a stock award or to satisfy a tax withholding obligation do not reduce the Share Reserve. If any shares of Common Stock issued pursuant to a stock award are forfeited back to or repurchased or reacquired by the Company (1) because of the failure to meet a contingency or vest, (2) to satisfy the exercise, strike or purchase price of an award, or (3) to satisfy a tax withholding obligation in connection with an award, the shares that are forfeited or repurchased or reacquired will revert back to the Share Reserve and will again become available for issuance under the Amended Plan.

Non-Employee Director Compensation Limit. The aggregate value of all compensation granted or paid to any non-employee director with respect to any period commencing on the date of the Company’s annual meeting of stockholders for a particular year and ending on the day immediately prior to the date of the Company’s annual meeting of stockholders for the next subsequent year, including awards granted under the Amended Plan and cash fees paid to such non-employee director, will not exceed (1) $1,000,000 in total value or (2) if such non-employee director is first appointed or elected to the Board during such annual period, $1,500,000 in total value, in each case, calculating the value of any equity awards based on the grant date fair value of such equity awards for financial reporting purposes.

Plan Administration. The Board, or a duly authorized committee thereof, will administer the Amended Plan and is referred to as the “plan administrator” herein. The Board may also delegate to one or more of the Company’s officers the authority to, among other things, (1) designate employees (other than officers) to receive specified stock awards and (2) determine the number of shares subject to such stock awards. Under the Amended Plan, the Board has the authority to determine award recipients, grant dates, the numbers and types of stock awards to be granted, the applicable fair market value and exercise price, and the provisions of each stock award, including the period of exercisability and the vesting schedule applicable to a stock award, subject to the limitations of the Amended Plan.

Under the Amended Plan, the Board also generally has the authority to effect, without the approval of stockholders but with the consent of any materially adversely affected participant, (1) the reduction of the exercise, purchase, or strike price of any outstanding option or stock appreciation right; (2) the cancellation of any outstanding option or stock appreciation right and the grant in substitution therefore of other awards, cash, or other consideration; or (3) any other action that is treated as a repricing under generally accepted accounting principles.

Stock Options. ISOs and NSOs are granted under stock option agreements approved by the plan administrator. The plan administrator determines the exercise price for stock options, within the terms and conditions of the Amended Plan, provided that the exercise price of a stock option cannot be less than 100% of the fair market value of a share of Common Stock on the date of grant. Options granted under the Amended Plan vest at the rate specified in the stock option agreement as determined by the plan administrator.

The plan administrator determines the term of stock options granted under the Amended Plan, up to a maximum of 10 years. Unless the terms of a participant’s stock option agreement provide otherwise or as otherwise provided by the plan administrator, if a participant’s service relationship with the Company or any of the Company’s affiliates ceases for any reason other than disability, death, or cause, the participant may generally exercise any vested options for a period of three months following the cessation of service. This period may be extended in the event that exercise of the option is prohibited by applicable securities laws. Unless the terms of a participant’s stock option agreement provide otherwise or as otherwise provided by the plan administrator, if a participant’s service relationship with the Company or any of the Company’s affiliates ceases due to death, or a participant dies within a certain period following cessation of service, the participant or a beneficiary of the participant may generally exercise any vested options for a period of 18 months following the date of death. Unless the terms of a participant’s stock option agreement provide otherwise or as otherwise provided by the plan administrator, if a participant’s service relationship with the Company or any of the Company’s affiliates ceases due to disability, the participant may generally exercise any vested options for a period of 12 months following the cessation of service. In the event of a termination for cause, options generally terminate upon the termination date. In no event may an option be exercised beyond the expiration of its term.

The plan administrator will determine the manner of payment of the exercise of a stock option, which may include (1) cash, check, bank draft or money order, (2) a broker-assisted cashless exercise, (3) the tender of shares of Common Stock previously owned by the participant, (4) a net exercise of the option if it is an NSO or (5) other legal consideration approved by the plan administrator.

Tax Limitations on ISOs. The aggregate fair market value, determined at the time of grant, of Common Stock with respect to ISOs that are exercisable for the first time by an award holder during any calendar year under all of the Company’s stock plans may not exceed $100,000. Options or portions thereof that exceed such limit will be treated as NSOs. No ISO may be granted to any person who, at the time of the grant, owns or is deemed to own stock possessing more than 10% of the Company’s total combined voting power or that of any of the Company’s parent or subsidiary corporations unless (1) the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant and (2) the term of the ISO does not exceed five years from the date of grant.

Restricted Stock Unit Awards. Restricted stock unit awards are granted under restricted stock unit award agreements approved by the plan administrator. Restricted stock unit awards will generally be granted in consideration for a participant’s services. The plan administrator determines the terms and conditions of restricted stock unit awards, including vesting and forfeiture terms, as well as the manner of settlement, which may be by cash, delivery of shares of Common Stock, a combination of cash and shares of Common Stock, or in any other form of consideration set forth in the restricted stock unit award agreement. Additionally, dividend equivalents may be credited in respect of shares covered by a restricted stock unit award. Except as otherwise provided in the applicable award agreement or by the plan administrator, restricted stock unit awards that have not vested will be forfeited once the participant’s continuous service ends for any reason.

Restricted Stock Awards. Restricted stock awards are granted under restricted stock award agreements approved by the plan administrator. A restricted stock award may be awarded in consideration for cash, check, bank draft or money order, services to us, or any other form of legal consideration that may be acceptable to the plan administrator and permissible under applicable law. The plan administrator determines the terms and conditions of restricted stock awards, including vesting and forfeiture terms. If a participant’s service relationship with the Company ends for any reason, the Company may reacquire any or all of the shares of Common Stock held by the participant that have not vested as of the date the participant terminates service with the Company through a forfeiture condition or a repurchase right.

Stock Appreciation Rights. Stock appreciation rights are granted under stock appreciation right agreements approved by the plan administrator. The plan administrator determines the strike price for a stock appreciation right, which cannot be less than 100% of the fair market value of Common Stock on the date of grant. A stock appreciation right granted under the Amended Plan vests at the rate specified in the stock appreciation right agreement as determined by the plan administrator. Stock appreciation rights may be settled in cash or shares of Common Stock or in any other form of payment, as determined by the plan administrator and specified in the stock appreciation right agreement.

The plan administrator determines the term of stock appreciation rights granted under the Amended Plan, up to a maximum of 10 years. Unless the terms of a participant’s stock appreciation rights agreement provide otherwise or as otherwise provided by the plan administrator, if a participant’s service relationship with the Company or any of its affiliates ceases for any reason other than cause, disability, or death, the participant may generally exercise any vested stock appreciation right for a period of three months following the cessation of service. This period may be further extended in the event that exercise of the stock appreciation right following such a termination of service is prohibited by applicable securities laws. Unless the terms of a participant’s stock appreciation rights agreement provide otherwise or as otherwise provided by the plan administrator, if a participant’s service relationship with the Company or any of its affiliates ceases due to disability or death, or a participant dies within a certain period following cessation of service, the participant or a beneficiary may generally exercise any vested stock appreciation right for a period of 12 months in the event of disability and 18 months in the event of death. In the event of a termination for cause, stock appreciation rights generally terminate immediately upon the occurrence of the event giving rise to the termination of the individual for cause. In no event may a stock appreciation right be exercised beyond the expiration of its term.

Performance Awards. The Amended Plan permits the plan administrator to grant performance awards, which may be settled in stock, cash or other property. Performance awards may be structured so that the stock, cash or a combination of stock and cash will be issued or paid only following the achievement of certain pre-established performance goals during a designated performance period as determined by the plan administrator. Performance awards that are settled in cash or other property are not required to be valued in whole or in part by reference to, or otherwise based on, Common Stock.

Other Stock Awards. The plan administrator may grant other awards based in whole or in part by reference to Common Stock. The plan administrator will set the number of shares under the stock award (or cash equivalent) and all other terms and conditions of such awards.

Changes to Capital Structure. In the event there is a specified type of change in the capital structure of the Company, such as a stock split, reverse stock split, or recapitalization, appropriate adjustments will be made to (1) the class and maximum number of shares reserved for issuance under the Amended Plan, (2) the class of shares by which the share reserve may increase automatically each year, (3) the class and maximum number of shares that may be issued on the exercise of ISOs, (4) the class and number of shares and exercise price, strike price, or purchase price, if applicable, of all outstanding stock awards, and (5) the performance goals of any award if the change in the capital structure affects such goals.

Corporate Transactions. The following applies to stock awards under the Amended Plan in the event of a Corporate Transaction (as defined in the Amended Plan), unless otherwise provided in a participant’s stock award agreement or other written agreement with the Company or one of its affiliates.

In the event of a Corporate Transaction, stock awards outstanding under the Amended Plan may be assumed or continued, or substitute awards may be issued, by any surviving or acquiring corporation (or its parent company), and any reacquisition or repurchase rights held by the Company with respect to the stock award may be assigned to the Company’s successor (or its parent company). If the surviving or acquiring corporation (or its parent company) does not assume, continue or issue substitute awards for such stock awards, then (i) with respect to any such stock awards that are held by participants whose continuous service has not terminated prior to the effective time of the Corporate Transaction, or current participants, the vesting (and exercisability, if applicable) of such stock awards will be accelerated in full (or, in the case of performance awards with multiple vesting levels depending on the level of performance, vesting will accelerate at 100% of the target level unless otherwise provided in the award agreement) to a date prior to the effective time of the Corporate Transaction (contingent upon the effectiveness of the Corporate Transaction), and such stock awards will terminate if not exercised (if applicable) at or prior to the effective time of the Corporate Transaction, and any reacquisition or repurchase rights held by the Company with respect to such stock awards will lapse (contingent upon the effectiveness of the Corporate Transaction), and (ii) any such stock awards that are held by persons other than current participants will terminate if not exercised (if applicable) prior to the effective time of the Corporate Transaction, except that any reacquisition or repurchase rights held by the Company with respect to such stock awards will not terminate and may continue to be exercised notwithstanding the Corporate Transaction.

In the event a stock award will terminate if not exercised prior to the effective time of a Corporate Transaction, the plan administrator may provide, in its sole discretion, that the holder of such stock award may not exercise such stock award but instead will receive a payment equal in value to the excess (if any) of (i) the value of the property the holder would have received upon the exercise of the award (including, at the discretion of the plan administrator, any unvested portion of such award), over (ii) any per share exercise price payable by such holder, if applicable, provided that the plan administrator may also determine that the payment to be made to such holder with respect to such award shall be made in the same form, at the same time and subject to the same conditions as the payments to be made to the Company’s stockholders in connection with the Corporate Transaction to the extent permitted by Section 409A of the Code. If the amount so determined for any award is $0, then such award shall be automatically cancelled at the effective time for no consideration.

Change in Control. Awards granted under the Amended Plan may be subject to acceleration of vesting and exercisability upon or after a change in control (as defined in the Amended Plan) as may be provided in the applicable stock award agreement or in any other written agreement between the Company or any affiliate and the participant, but in the absence of such provision, no such acceleration will automatically occur.

Transferability. A participant may not transfer stock awards under the Amended Plan other than by will, the laws of descent and distribution, or as otherwise provided under the Amended Plan.

Recoupment. Awards granted under the Amended Plan are subject to recoupment in accordance with any clawback policy adopted by the Board.

Plan Amendment or Termination. The Board has the authority to amend, suspend, or terminate the Amended Plan at any time, provided that such action does not materially impair (within the meaning of the Amended Plan) the existing rights of any participant without such participant’s written consent. Certain material amendments also require approval of the stockholders of the Company. No ISOs may be granted after the tenth anniversary of the date that the Board adopts the Plan. No stock awards may be granted under the Amended Plan while it is suspended or after it is terminated.

U.S. Federal Income Tax Consequences

The following is a summary of the principal U.S. federal income tax consequences to participants and the Company with respect to participation in the Amended Plan. This summary is not intended to be exhaustive and does not discuss the income tax laws of any local, state or foreign jurisdiction in which a participant may reside. The information is based upon current U.S. federal income tax rules and therefore is subject to change when those rules change. Because the tax consequences to any participant may depend on such participant’s particular situation, each participant should consult the participant’s tax adviser regarding the federal, state, local and other tax consequences of the grant, exercise, vesting or settlement of an award or the disposition of stock acquired under the Amended Plan. The Amended Plan is not qualified under the provisions of Section 401(a) of the Code and is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Tax Consequences to the Participants

Nonstatutory Stock Options. Generally, there is no taxation to the participant upon the grant of a NSO. Upon exercise, a participant will recognize ordinary income equal to the excess, if any, of the fair market value of the underlying stock on the date of exercise of the stock option over the exercise price. If the participant is employed by the Company or one of its affiliates, that income will be subject to withholding taxes. The participant’s tax basis in those shares will be equal to their fair market value on the date of exercise of the stock option, and the participant’s capital gain holding period for those shares will begin on the day after they are transferred to the participant.

Incentive Stock Options. The Amended Plan provides for the grant of stock options that are intended to qualify as “incentive stock options,” as defined in Section 422 of the Code. A participant generally is not subject to ordinary income tax upon the grant or exercise of an ISO. If the participant holds a share received upon exercise of an ISO for more than two years from the date the stock option was granted and more than one year from the date the stock option was exercised, which is referred to as the required holding period, then the difference, if any, between the amount realized on a sale or other taxable disposition of that share and the exercise price paid by the participant for that share will be long-term capital gain or loss. If, however, a participant disposes of a share acquired upon exercise of an ISO before the end of the required holding period, which is referred to as a disqualifying disposition, then the participant generally will recognize ordinary income in the year of the disqualifying disposition equal to the excess, if any, of the fair market value of the share on the date of exercise of the stock option over the exercise price. However, if the sales proceeds are less than the fair market value of the share on the date of exercise of the stock option, the amount of ordinary income recognized by the participant will not exceed the gain, if any, realized on the sale. If the amount realized on a disqualifying disposition exceeds the fair market value of the share on the date of exercise of the stock option, that excess will be short-term or long-term capital gain, depending on whether the holding period for the share exceeds one year. For purposes of the alternative minimum tax, the amount by which the fair market value of a share of stock acquired upon exercise of an ISO exceeds the exercise price of the stock option generally will be an adjustment included in the participant’s alternative minimum taxable income for the year in which the stock option is exercised. If, however, there is a disqualifying disposition of the share in the year in which the stock option is exercised, there will be no adjustment for alternative minimum tax purposes with respect to that share. In computing alternative minimum taxable income, the tax basis of a share acquired upon exercise of an ISO is increased by the amount of the adjustment taken into account with respect to that share for alternative minimum tax purposes in the year the stock option is exercised.

Restricted Stock Awards. Generally, a participant who is granted a restricted stock award will recognize ordinary income at the time the stock is received equal to the excess, if any, of the fair market value of the stock received over any amount paid by the participant in exchange for the stock. If, however, the stock is subject to restrictions constituting a substantial risk of forfeiture when it is received (for example, if the employee is required to work for a period of time in order to have the right to transfer or sell the stock), the participant generally will not recognize income until the restrictions constituting the substantial risk of forfeiture lapse, at which time the participant will recognize ordinary income equal to the excess, if any, of the fair market value of the stock on the date of such lapse over any amount paid by the participant in exchange for the stock. A participant may, however, file an election with the Internal Revenue Service, within 30 days following the date of grant, to recognize ordinary income, as of the date of grant, equal to the excess, if any, of the fair market value of the stock on the date the award is granted over any amount paid by the participant for the stock. The participant’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired from a restricted stock award will be the amount paid for such shares plus any ordinary income recognized either when the stock is received or when the restrictions constituting a substantial risk of forfeiture lapse.

Restricted Stock Unit Awards. Generally, a participant who is granted a restricted stock unit award will recognize ordinary income at the time the stock is delivered equal to (1) the excess, if any, of the fair market value of the stock received over any amount paid by the participant in exchange for the stock or (2) the amount of cash paid to the participant. The participant’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired from a restricted stock unit award will be the amount paid for such shares plus any ordinary income recognized when the stock is delivered, and the participant’s capital gain holding period for those shares will begin on the day after they are transferred to the participant.

Stock Appreciation Rights. Generally, a participant who is granted a stock appreciation right will recognize ordinary income equal to the fair market value of the stock or cash received upon such exercise.

Performance Awards and Other Stock Awards. Generally, a participant who is granted a performance award or other stock award will recognize ordinary income equal to the fair market value of the stock received over any amount paid by the participant in exchange for such stock, or the amount of cash paid to the participant.

Tax Consequences to the Company

General. In each case described above, the Company will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the participant with respect to the stock award at the same time the participant recognizes such ordinary income. the Company’s ability to realize the benefit of any tax deductions depends on the Company’s generation of taxable income as well as the requirement of reasonableness and the satisfaction of the Company’s tax reporting obligations.

Compensation of Covered Employees. The ability of the Company to obtain a deduction for amounts paid under the Amended Plan could be limited by Section 162(m) of the Code. Section 162(m) of the Code limits the Company’s ability to deduct compensation, for U.S. federal income tax purposes, paid during any year to a “covered employee” (within the meaning of Section 162(m) of the Code) in excess of $1 million.

Golden Parachute Payments. The ability of the Company (or the ability of one of its subsidiaries) to obtain a deduction for future payments under the Amended Plan could also be limited by the golden parachute rules of Section 280G of the Code, which prevent the deductibility of certain “excess parachute payments” made in connection with a change in control of an employer-corporation.

New Plan Benefits and Historical Equity Awards

The Compensation Committee has the discretion to grant awards under the Amended Plan and, therefore, it is not possible as of the date of this proxy statement to determine future awards that will be received by the Company’s executive officers or others under the Amended Plan. Please see the section entitled “Executive Compensation—Overview of Executive Compensation Program—Equity Compensation Plan Information” for more information.

The following table sets forth the number of stock options that have been granted under the Amended Plan to named executive officers and the other individuals and groups indicated since the inception of the Amended Plan.

| Name and Position | | Stock

Options | |

| Brian G. Atwood, Chief Executive Officer, Chairman and Director | | | 1,317,956 | |

| Charles R. Carter, Chief Financial Officer | | | 395,387 | |

| Daniel Corey, M.D., Chief Technology Officer, Director and Founder | | | 856,671 | |

| All current executive officers (three executive officers) | | | 2,570,014 | |

| All current non-employee directors | | | 977,182 | |

| All employees and consultants (other than executive officers) | | | 1,041,423 | |

If the Company’s stockholders approve this proposal, the Amendment will become effective as of the date on which the Amendment is approved by stockholders, and awards may be granted under the Amended Plan. If the Company’s stockholders do not approve the Amendment, the Company will continue to grant awards under the existing Plan as long as shares are available for such purpose.

Interests of Directors and Executive Officers

Our current directors and executive officers have substantial interests in the matters set forth in this proposal since equity awards may be granted to them under the Amended Plan.

Vote Required; Board Recommendation

The affirmative vote of the holders of a majority of the votes cast at the Special Meeting will be required to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE PLAN AS AMENDED TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK AVAILABLE FOR ISSUANCE UNDER THE PLAN AND THE NUMBER OF SHARES THAT MAY BE ISSUED PURSUANT TO INCENTIVE STOCK OPTIONS BY AN ADDITIONAL 2,000,000 SHARES. | ✓ |

PROPOSAL 5: APPROVAL OF AN ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THAT THERE ARE INSUFFICIENT VOTES IN FAVOR OF PROPOSALS 2 AND 3

Overview

If the Company fails to receive a sufficient number of votes to approve Proposals 2 and 3, the Company may propose to adjourn or postpone the Special Meeting. The Company currently does not intend to propose an adjournment or postponement at the Special Meeting if there are sufficient votes to approve Proposals 2 and 3.

Vote Required; Board Recommendation

The affirmative vote of the holders of a majority of the votes cast at the Special Meeting will be required to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF AN ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THAT THERE ARE INSUFFICIENT VOTES IN FAVOR OF PROPOSALS 2 AND 3. | ✓ |

DESCRIPTION OF CAPITAL STOCK

The following summary of the material terms of CERo’s securities is not intended to be a complete summary of the rights and preferences of such securities. You are encouraged to read the applicable provisions of Delaware law, the Charter, Bylaws and the Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock (the “Series A Certificate of Designations”) and the Certificate of Designation of Preferences, Rights and Limitations of the Series B Convertible Preferred Stock (the “Series B Certificate of Designations”) in their entirety for a complete description of the rights and preferences of the Company’s securities.

General

The Company is authorized to issue up to 1,000,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”).

Preferred Stock

The Board is aware of no other matter thatauthorized to issue “blank check” Preferred Stock, which may be brought beforeissued in one or more series upon the Special Meeting. Under Delaware law, only business thatauthorization of the Board. The Board is specified inauthorized to fix the Notice may be transacted atdesignations, powers, preferences and the Special Meeting.

FUTURE STOCKHOLDER PROPOSALS

If the Charter Amendment Proposalrelative, participating, optional or other special rights and Trust Amendment Proposal are not approvedany qualifications, limitations and we do not consummate an initial business combination by January 8, 2023, we do not expect to hold any future annual meetings.

Stockholder Communications

Stockholders and interested parties may communicate with the Board, any committee chairperson, or the non-management directors as a group by writing to the Board or committee chairperson in carerestrictions of 2201 Broadway, Suite 705, Oakland, CA 94612.

Transfer Agent; Warrant Agent and Registrar

The registrar and transfer agent for the shares of common stock and the warrant agent for warrants is Continental Stock Transfer & Trust Company.each series of Preferred Stock. The Company has agreed to indemnify Continental Stock Transfer & Trust Company in its roles as transfer agent and warrant agent against all liabilities, including judgments, costs and reasonable counsel fees that may arise out of acts performed or omitted for its activities in that capacity, except for any liability due to any gross negligence, willful misconduct or bad faithauthorized shares of the indemnified personPreferred Stock are available for issuance without further action by the Company’s stockholders, unless such action is required by applicable law or entity.

Delivery of Documents to Stockholders

Pursuant to the rules of any stock exchange on which the SEC,securities may be listed. If the approval of the Company’s stockholders is not required for the issuance of shares of the Preferred Stock, the Board may determine not to seek stockholder approval.

The Board will be able to, without stockholder approval, issue Preferred Stock with voting and other rights that could adversely affect the voting power and other rights of the holders of the Common Stock and could have anti-takeover effects. The ability of the Board to issue Preferred Stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of the Company and servicers that it employs to deliver communications to its stockholders are permitted to deliver to two or more stockholders sharing the same address a single copyremoval of this proxy statement. Upon written or oral request, we will deliver a separate copy of this proxy statement and the accompanying Annual Report on Form 10-K for the year ended December 31, 2021 to any stockholder at a shared address to which a single copy of this proxy statement was delivered and who wishes to receive separate copies in the future. Stockholders receiving multiple copies of this proxy statement may likewise request delivery of single copies of proxy statements in the future. Stockholders may notify us of their requests by calling or writing at our principal executive offices at (215) 731-9450 and 2201 Broadway, Suite 705, Oakland, CA 94612.